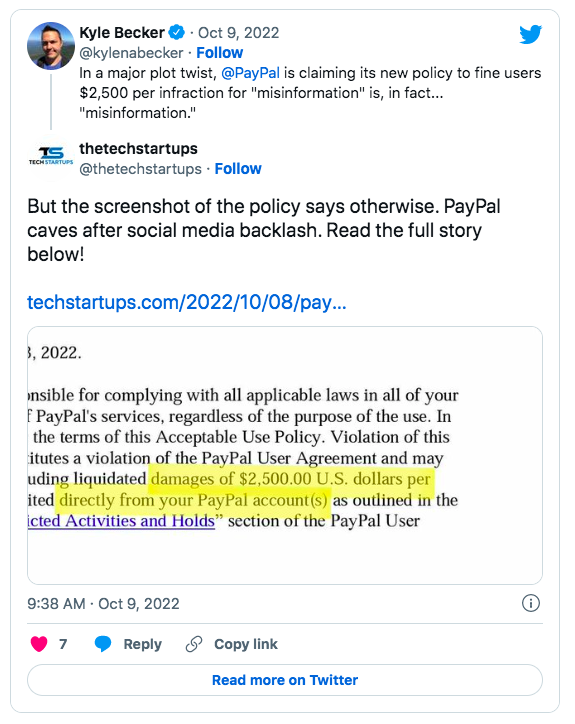

PayPal says policy to punish users for misinformation was 'in error'

Online payment network PayPal has reneged on a controversial policy that could’ve seen users fined $2,500 for spreading “misinformation,” with the payment platform claiming the policy update was published “in error.”

The now retracted misinformation clause in PayPal’s Acceptable Use Policy (AUP) was set to take effect on Nov. 3, which would have expanded on its list of prohibited activities to include “the sending, posting, or publication of any messages, content, or materials” that "promotes misinformation."

PayPal has since told multiple outlets reporting on the clause that the updated AUP went out in error and included incorrect information, clarifying that it would not fine its users for spreading misinformation:

“PayPal is not fining people for misinformation and this language was never intended to be inserted in our policy [...] Our teams are working to correct our policy pages. We’re sorry for the confusion this has caused."

The controversy has spread like wildfire on Twitter among both crypto and non-crypto observers, with some continuing to comment on the issue even after the retraction.

Lightspark CEO and former PayPal president David Marcus, called it “insanity” that "a private company now gets to decide to take your money if you say something they disagree with.”

Tesla CEO and former PayPal co-founder Elon Musk responded to Marcus’ tweet with “Agreed.”

Maple Finance co-founder Sid Powell said the case at hand provides a textbook example as to why it is essential to have custody over your own funds.

Founder and CEO of crypto consulting and education platform Eight Michaël van de Poppe kept his opinion short and sweet, calling it “The end of PayPal.”

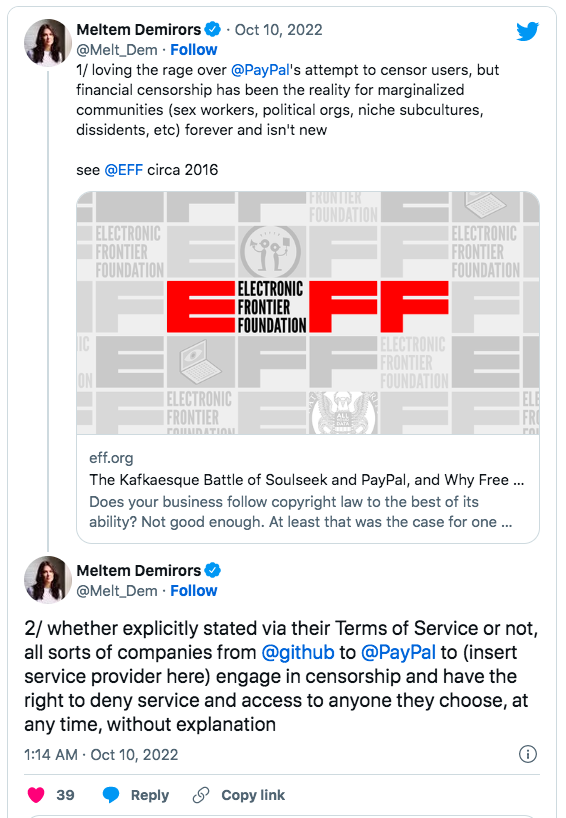

But not everyone considered PayPal’s now retracted clause to be dishonorable to its users.

Chief Strategy Officer Meltem Demirors of digital asset investment firm CoinShares said that in any event, companies have the right to choose who can use its services without explanation:

“And if you think crypto is immune you're either naive or willfully ignorant,” she said, adding:

“Currently, 31% of post-merge Ethereum blocks are OFAC-compliant, meaning they censor transactions associated with specific contracts and addresses on a state-sponsored list.”

While the implementation of a fine would’ve been a first for PayPal, the payment giant is no stranger to deplatforming users it isn’t politically aligned with, having cut ties with domain registrar Epik in Oct. 2020 who provided services to the Proud Boys and other conservative groups.

Similarly to the broader stock market, PayPal (PYPL) has plummeted 64.65% over the last 12 months according to Yahoo Finance.

The NASDAQ is due to re-open on Sept. 10 at 9:30 am Eastern Time, so it remains to be seen whether the clause and its subsequent retraction will impact PayPal’s share price.

This article is authorized for publication, and unless the source is indicated, it is submitted by users and does not represent the position of our website. If the content involves investment suggestions, it is for reference only and not as an investment basis.