Terra Luna Price Prediction as Binance Burns $1.8 Million LUNC

The Terra Luna Classic (LUNC) price has dropped slightly in the past 24 hours, dipping by 0.5% to $0.00031545. Yet it remains up by 3% in a week and by 22% in a month, driven largely by Binance having completed a burn of all the trading fees it has collected from LUNC trading between September 21 and October 1.

This amounts to some $1.8 million in LUNC, which given the altcoin's current price, is equivalent to the burning of roughly 5.8 billion LUNC. The market appears to have taken such large-scale destruction as a sign that Binance is willing to support the rehabilitation of LUNC's price, which infamously collapsed in May after Terra issued billions of new LUNC (then known as LUNA) in order to shore up the price of stablecoin UST.

However, with LUNC now over 30,000% up after plunging to an all-time low of $0.000000999967 on May 13, Binance's intervention raises hopes that the disgraced altcoin could continue its near-miraculous recovery. The thing is, while its fractional price does hold out hope of further rises, the lack of a real use case for LUNC means that it's just a plaything of speculators, and may plunge again once they move on to the next trending coin.

Terra Luna Price Prediction as Binance Burns $1.8 Million LUNC

Despite its recent rises, it's worth remembering that LUNC is still down by nearly 100% since its all-time high of $119.18, set back in April.

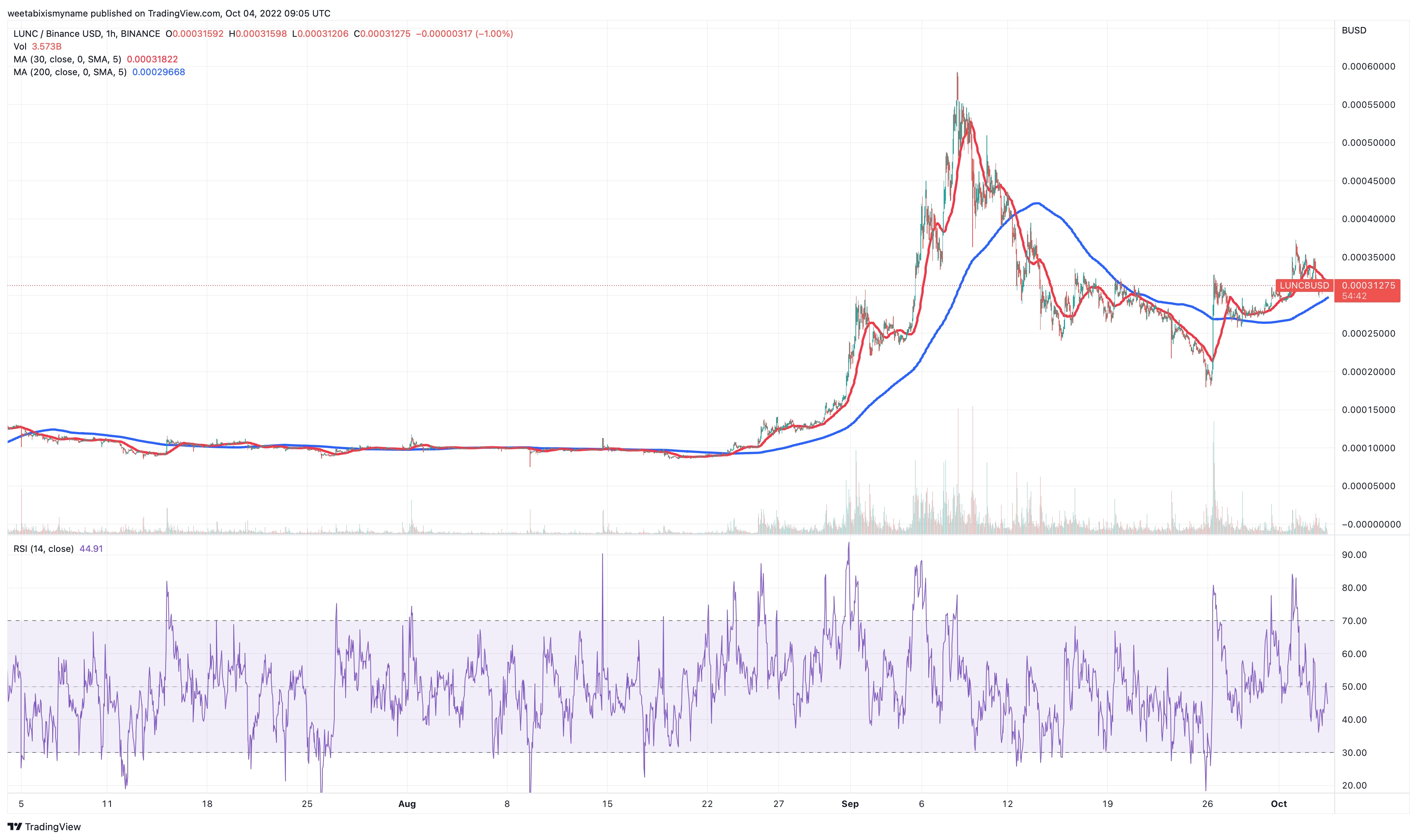

LUNC's indicators spiked at the beginning of this month, with its relative strength index (purple) surpassing 80. At the same time, its 30-day moving average (red) surged to rise comfortably above its 200-day average (blue), signalling a breakout of sorts.

Now, these indicators have reversed a little, portending a loss of momentum. Its RSI is down below 50, while its 30-day average looks as though it's in the process of falling below its 200-day, something which risks forming a 'death cross.'

Regardless of current price trends, the past week or so has been promising for LUNC. In particular, Binance's commitment to burning trading fees collected in LUNC goes some way towards reducing the altcoin's massive supply, which ballooned from roughly 1 billion pre-Terra collapse to 6.9 trillion as of writing.

And yesterday's burn of roughly $1.8 million in LUNC won't be the first for Binance either, with the example it's setting potentially establishing a trend that other major exchanges may follow. Of course, they will have to burn an incredible amount of LUNC to get the altcoin's price back up to whole numbers.

Passing Fad?

Indeed, roughly 99.99% of all circulating LUNC needs to be burned in order for its supply to return to the one billion level. This is not going to happen, creating the suspicion that the current trend for LUNC is something that's happening because the wider market continues to weather a downturn, meaning that aren't many other opportunities for sudden price pumps.

Realistically, if future Binance burns also destroy around 5.8 billion LUNC, the market will need about a thousand of these to get the LUNC supply down to roughly 1 trillion. This is still one thousand times larger that LUNC's former supply of 1 billion.

As such, it's extremely unlikely that LUNC will ever regain its previous all-time high. Assuming that Binance completes one thousand burns (which is also highly optimistic), LUNC may end up reaching $0.31 in the very long term.

This may leave more than a few LUNC holders disappointed, yet even with a bear market, there are a few new altcoins that offer scope for significant price gains while also having some good fundamentals. To take only one example, metaverse-based meme token Tamadoge (TAMA) has risen by 90% in the past day, on the back of its new OKX listing, and a potential Binance listing.

As for LUNC, it can continue to rise in the short-term, especially if Binance continues its burns. But with nothing fundamental holding its price up, don't expect sustained increases for too long.

This article is authorized for publication, and unless the source is indicated, it is submitted by users and does not represent the position of our website. If the content involves investment suggestions, it is for reference only and not as an investment basis.