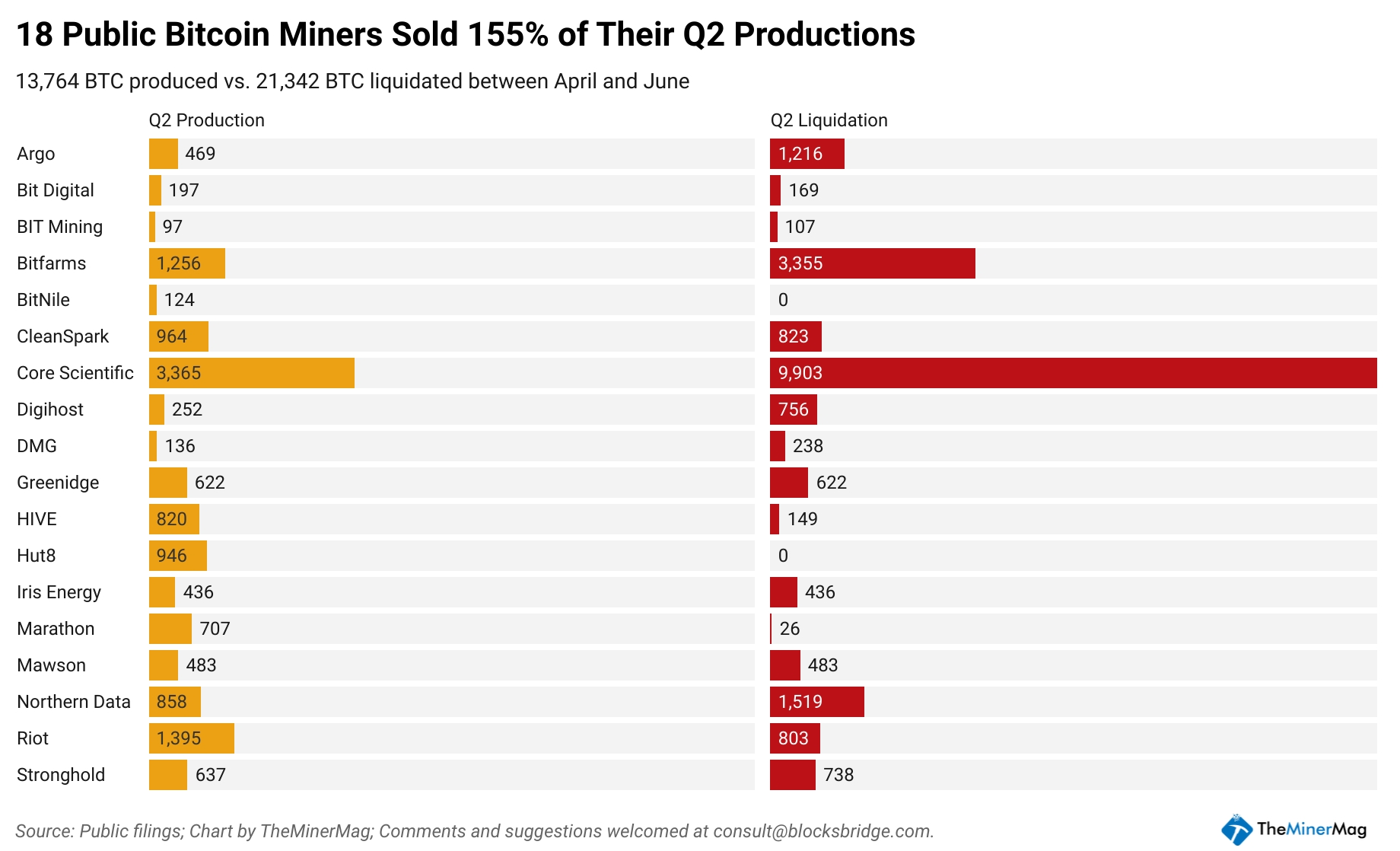

The second quarter of 2022 was a difficult one for public bitcoin (BTC) miners, as 18 of them sold BTC 21,342, according to a recent report released by crypto consultancy BlocksBridge Consulting.

Per the report, this was 660% of what they sold in the first quarter of this year and about 150% of their production in the April-June 2022 period.

The latest data obtained by the firm suggests that bitcoin production costs, as well as general and interest expenses increased in the second quarter of this year.

According to the consultancy,

“Q2 numbers from eight public miners who have released full financial statements so far show that their average cots of production, general and interest expenses per each bitcoin mined spiked by 22% in Q2 vs Q1. They represent ~10% of the network hashrate.”

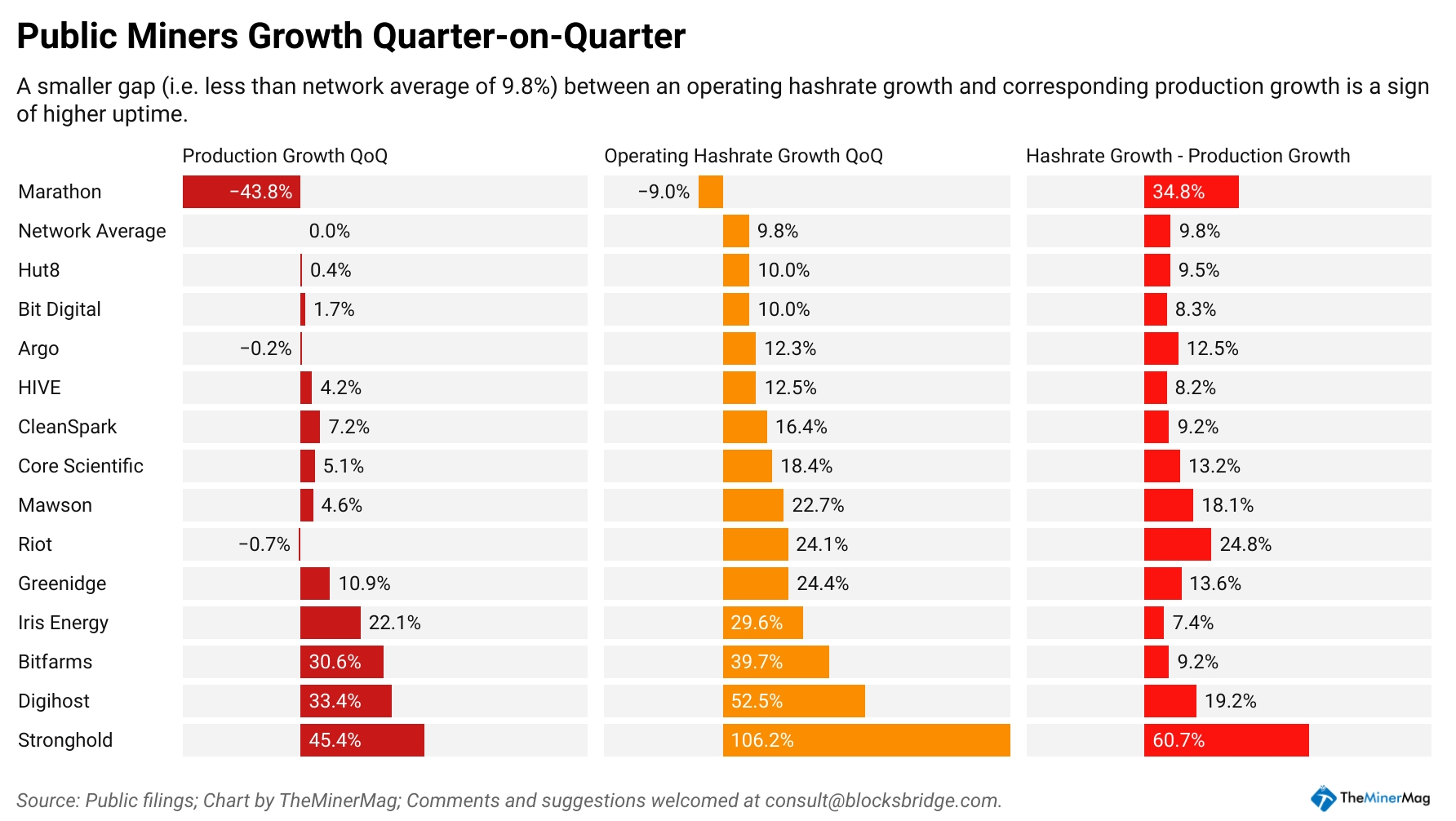

The report recognizes that, on the bright side, almost every public mining company managed to outgrow the network’s hashrate rise in the second quarter, that is, the April-June 2022 period.

“But QoQ [quorter-on-quarter] production growth lagged a lot behind the operating hashrate growth. Why? Not everyone was able to maintain a good uptime,” BlocksBridge said.

According to ByteTree data, miners have spent more of their newly generated BTC, compared to what they’ve held over the past 12 weeks. However, this trend has changed in the past seven days.

Meanwhile, Bitcoin mining difficulty, or the measure of how hard it is to compete for mining rewards, increased on August 18 by 0.77%, currently standing at 28.57 T. This was its third in a series of smaller increases, with the difficulty inching towards its May all-time high of 31.25 T.

Last week, Bitfinex Analysts said in a comment shared with Cryptonews.com that,

"Bitcoin mining reports indicate that there has been a notable decrease in miner distribution to exchanges in recent weeks. This suggests that whilst stress remains in the industry; the worst may well be behind us. As pressure on miners decreases, alongside whales, miners also appear to be taking profits. They are basically forced into selling to cover costs from the additional mining rigs onboarded with their infrastructure as collateral. Over the last 2-weeks, the aggregate miner balance has declined by approximately 4.7k BTC."

The rising production costs could be one of the reasons behind a number of recent decisions made by mining-related companies.

One of Japan’s biggest financial services providers, SBI Holdings announced it is shutting down its mining operations in Siberia. The move also ties back to the sanctions imposed on Russia for its invasion of its western neighbor, Ukraine.

CleanSpark said that it recognized a USD 29.3m net loss for the three months ended June 30, but it has also completed the recently announced acquisition of an active bitcoin mining facility in the US just three days ago.

Meanwhile, Kryptovault AS was forced by soaring power prices to move north from southern Norway to the Arctic Circle, where the power costs are a lot lower.

Earlier this month, it was also unveiled that the construction of a bitcoin mining facility near a Pennsylvania-based nuclear plant was suspended. Taryne Williams, a spokesperson for Talen Energy, told the local daily Standard-Speaker that the construction work was suspended “due to circumstances out of our control.” The statement may suggest that the decision could be related to crypto prices tanking in the past months.

At 9:30 UTC on Monday morning, BTC was trading at USD 21,182, down 1% in a day and 13% in a week.

Copyright © 2022.AssessCrypto All rights reserved.