Bitcoin (BTC) set a new all-time high for hash rate last week, but opinions are divided as to whether the uptrend can continue.

In a Twitter debate on March 21, Preston Pysh, host of The Investor‘s Podcast, eyed changing behavior in Bitcoin‘s hash ribbons metric for signs of a new hash rate “lull.”

Bitcoin has overcome considerable odds over the past year to see the processing power dedicated to mining — hash rate — reach a giant 222 exahashes per second (EH/s) this month, according to estimates from monitoring resource MiningPoolStats.

First China sparking a mass miner exodus, then this year‘s crackdown of mining hubs in Kazakhstan put the cat among the pigeons in terms of miner operation.

Nonetheless, a full recovery ensued on both occasions, reinforcing the idea that as long as there is at least one “friendly” jurisdiction for miners, mining will come back harder than ever before.

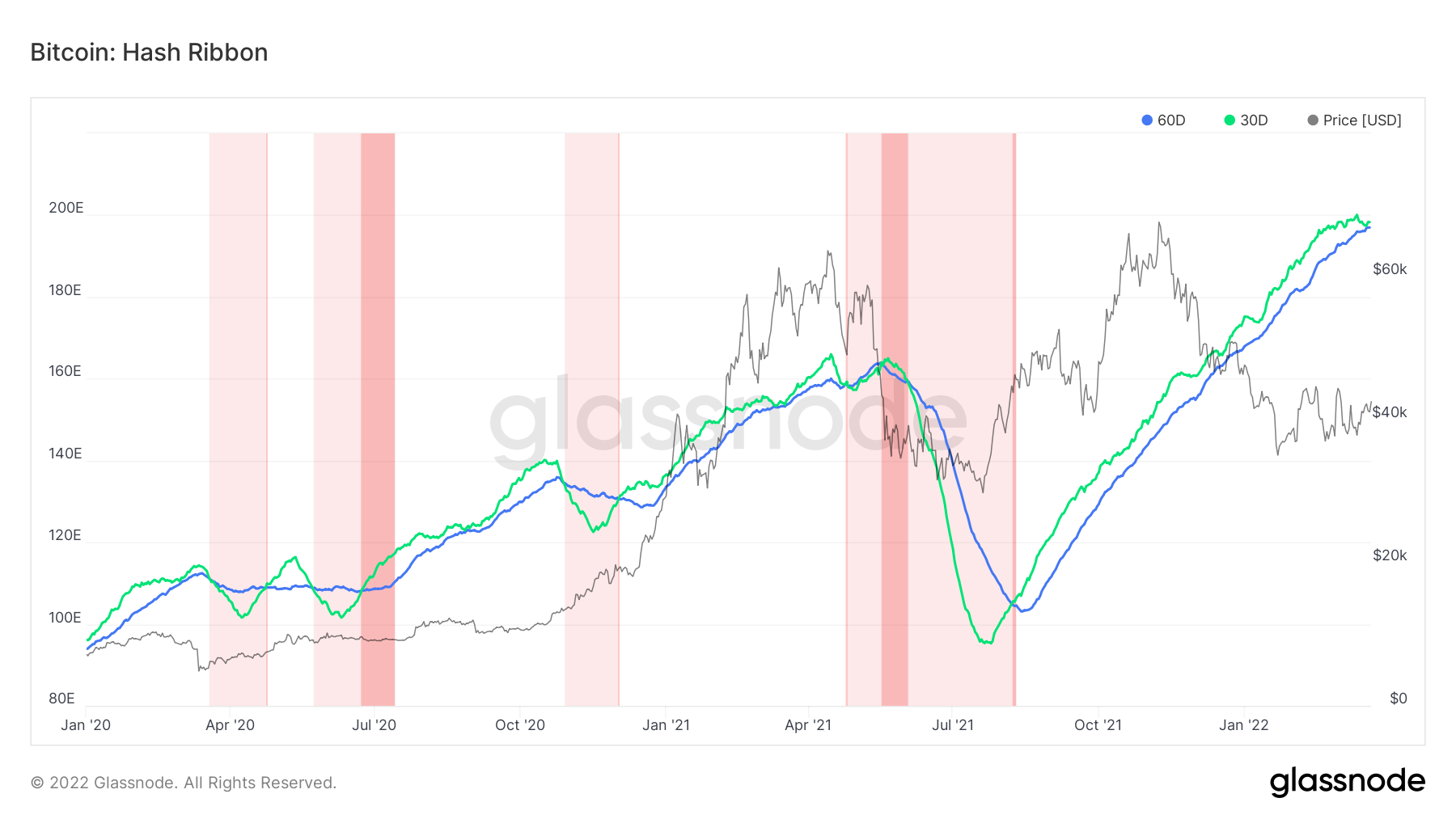

Hash ribbons use two simple moving averages (SMAs) of hash rate to assess miner health and has been used to conclude when likely price bottoms are near based on that health.

Miners have a breakeven cost for producing each Bitcoin, and when the spot price is lower than that cost, the danger arises that they will begin to “capitulate,” or cease operations due to a lack of profitability. This has the knock-on effect of reducing price performance, and an adjustment in Bitcoin network difficulty is needed to lower miners‘ production costs en masse.

In terms of hash ribbons, when the 30-day SMA crosses under the 60-day SMA, this suggests a capitulation event — at least large enough to measure — has occurred.

“A simple 1- and 2-month simple moving average of Bitcoin’s hash rate can be used to identify market bottoms, miner capitulation and — even better — great times to buy Bitcoin,” Charles Edwards, CEO of asset manager Capriole, who created the metric, explained in a blog post in 2019.

“When the 1-month SMA of Hash Rate crosses over the 2-month SMA of Hash Rate, the worst of the miner capitulation is typically over, and the recovery has begun.”

This time, events in Kazakhstan could have formed the trigger for a capitulation event, which has, nonetheless, already been erased in terms of hash rate growth.

“Margins are still very healthy. Production cost is low-mid 30s. Electrical (running) cost is low 20s,” Edwards responded to Pysh, referencing a theory by Blockware analyst Joe Burnett.

“I think (Burnett's) reasoning re- Kazakhstan is most logical. So perhaps a small capitulation (provided broader macro/market strength).”

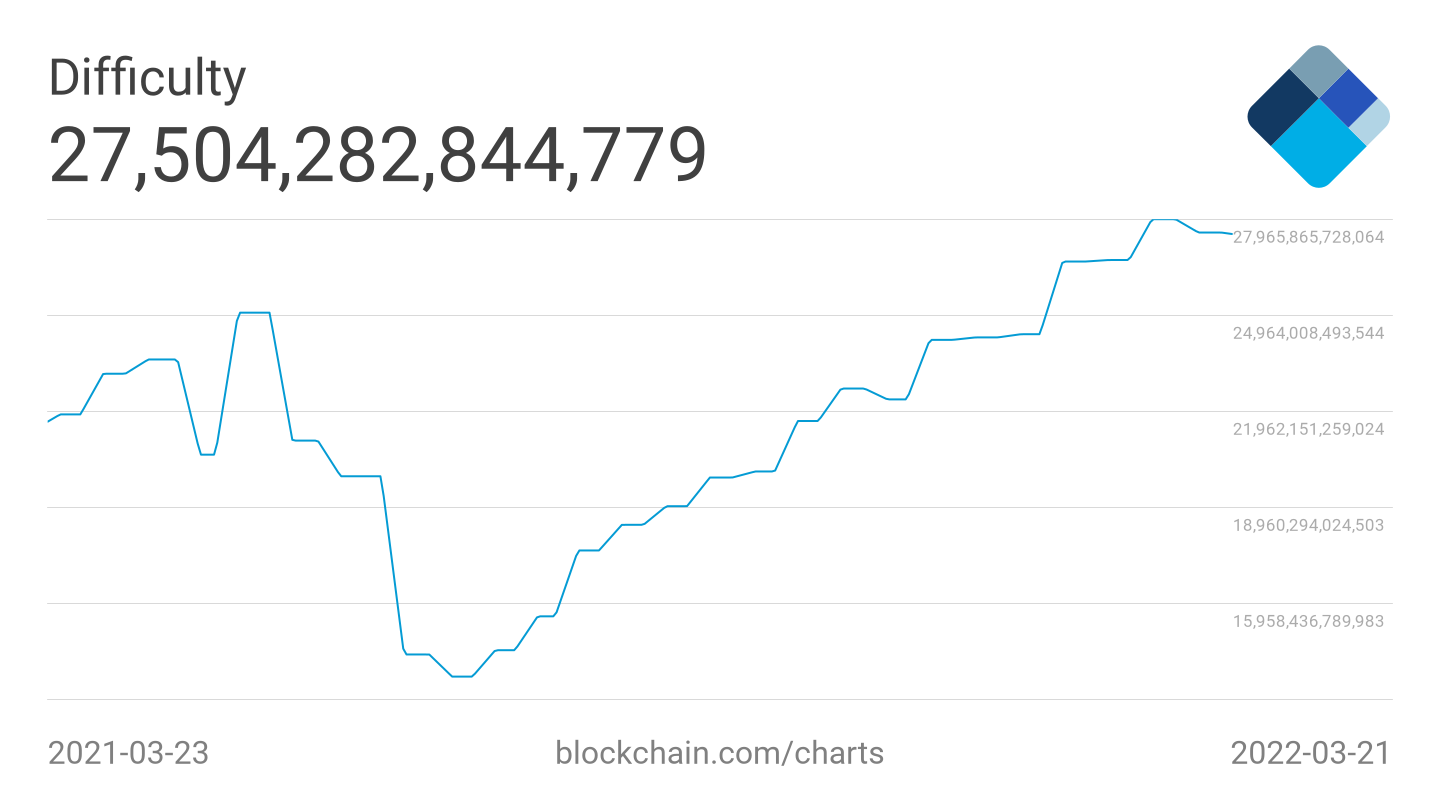

It‘s not just hash rate: Mining difficulty is also enjoying a winning streak that looks set to resume this month after its own brief consolidation.

Related: Bitcoin ‘could easily see $30K’ with stocks due to 30% drawdown in 2022 — Analyst

As the most important of Bitcoin‘s fundamentals indicators, the difficulty is set to increase by an estimated 4.66% at the next automated readjustment in eight days‘ time.

The last two readjustments were both negative, but only just, meaning the upcoming increase will send difficulty to new all-time highs of 28.73 trillion.

Copyright © 2022.AssessCrypto All rights reserved.