Cryptocurrency risk management firm Elliptic has released a report suggesting that scammers stole more than $100 million worth of nonfungible tokens, or NFTs, starting in 2021.

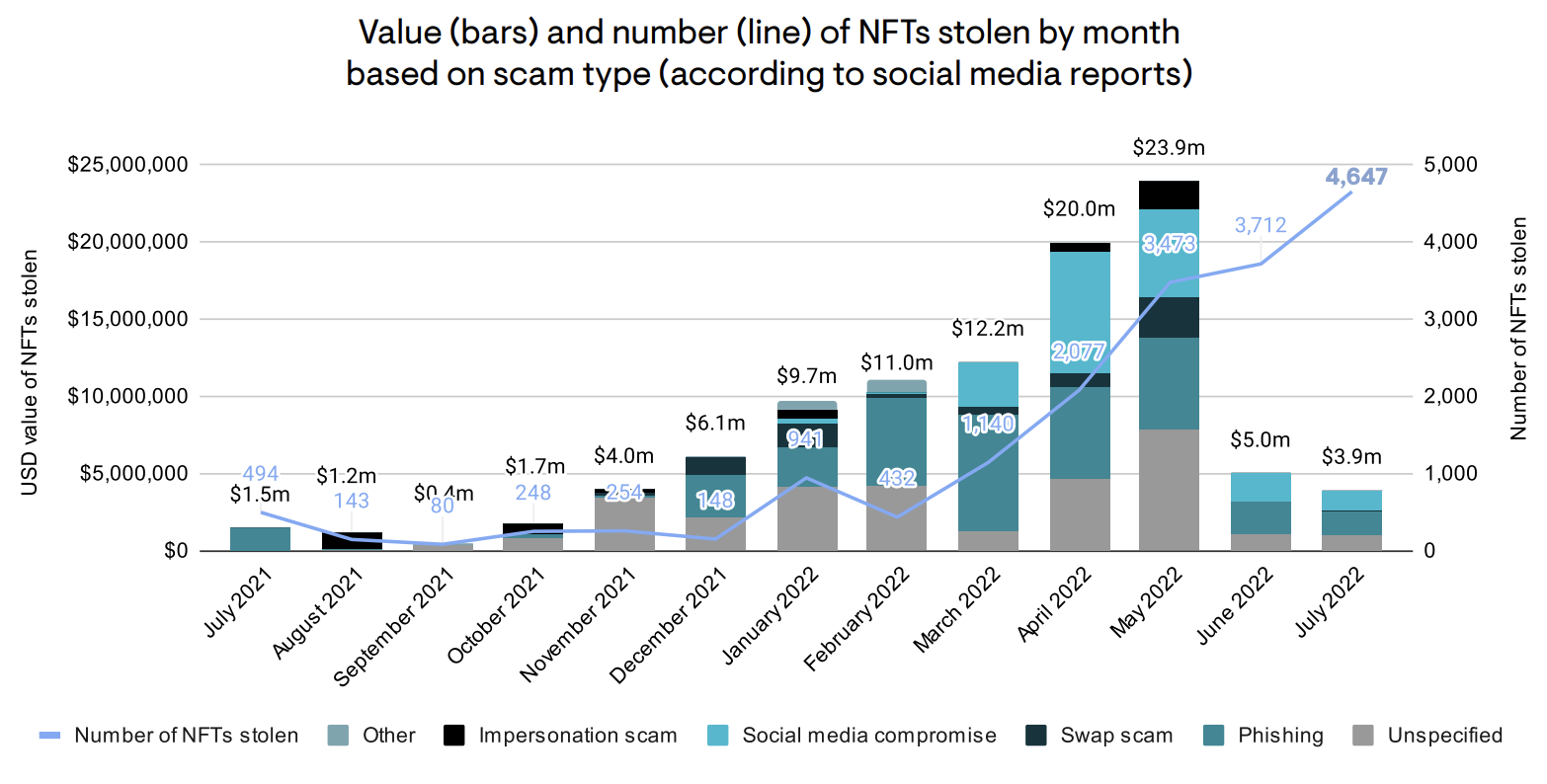

In its NFTs and Financial Crime report released on Wednesday, Elliptic said crypto users had been the victims of roughly $100.6 million worth of scams related to NFTs in the 13-month period from July 2021 to July 2022. The firm reported that although the market downturn had caused the value of NFTs to “slump,” scammers stole the most tokens in July 2022 — estimated to be 4,647 assets — and the most value in May 2022 at roughly $23.9 million.

According to Elliptic, the most valuable NFT theft the firm verified as part of its analysis was a CryptoPunk valued at $490,000 at the time it was stolen in November 2021. In December 2021, scammers were able to pilfer “16 blue chip NFTs worth $2.1 million” from a single victim in the crypto space.

The report stated that individuals had laundered more than $8 million in illicit funds through NFT platforms since 2017, while more than $328 million went through cryptocurrency mixers including Tornado Cash, sanctioned by the United States Office of Foreign Asset Control in August. The controversial mixer reportedly processed $137.6 million worth of crypto from NFT platforms and was “the laundering tool of choice” for the majority of scams.

It’s unclear how close the aforementioned figures were to the true value of crypto and NFTs involved in scams, as many go unreported or are identified after the fact. Elliptic reported more than 2,000 NFTs were stolen at a rough value of $20 million in April 2022, but the fake airdrop targeting Bored Ape Yacht Club NFT holders accounted for an estimated tens of millions of dollars stolen at the time. Elliptic's data suggested that scammers removed $58.1 million worth of Ape NFTs from the Bored Ape Yacht Club and Mutant Ape Yacht Club in July 2022.

“Across June and July 2022, thefts of valuable NFTs decreased while those affecting lower value early-stage projects rose,” said Elliptic. “This trend likely partially reflects valuable NFT owners "hodling" their assets throughout the bear market and not engaging as actively with new projects vulnerable to scammer activity.”

Scammers continue to employ a variety of methods to relieve crypto users of their NFTs — through phishing attacks, exploits of a marketplace and others. The tokens recently became the target of a class-action lawsuit with the potential to influence how the U.S. Securities and Exchange Commission may view assets in the crypto space as securities.

Previous article

Copyright © 2022.AssessCrypto All rights reserved.